Window Treatment Financing

Love Your Window Treatments Now – Pay Over Time

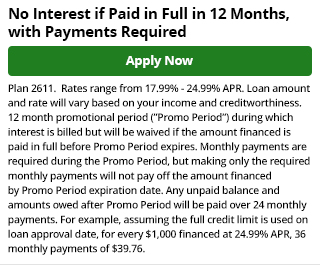

Special 6 or 12-Month Financing Options Available With No Interest if Paid in Full During That Time 2

Flexible Financing for Made-to-Order Window Treatments

Ready to upgrade to custom shutters, blinds or shades? We have straightforward financing options through our partner, GreenSky®.

With GreenSky financing options, there’s no reason to put off your new shutters, blinds or shades.

Thanks to special 12-month financing, you have the flexibility to wrap up your project on your own terms. And if you pay your balance off in the promotional period, you won’t see a cent of interest.

Applying for financing with GreenSky is straightforward, secure and offers possible same-day authorization. Work with your Louver Shop consultant to get started.

Schedule a FREE, No-Obligation In-Home Design Consultation

Call 888-428-1415, Chat Live or Submit Below

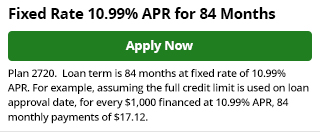

Financing Details

- GreenSky® financing is subject to credit approval.

- Minimum monthly payments are required during the promotional financing period. However, making minimal monthly payments during the promotional period will not pay off the entire principal balance.

- Interest is billed during the promotional period. But all interest is waived if the purchase amount is paid in full before the promotional period expires.

- Financing for GreenSky® consumer loan programs is provided by federally insured, equal opportunity lender banks.

Frequently Asked Financing Questions

Why should I finance my project when I can pay cash or use a credit card?

What type of credit is available?

Where Can I Use My Loan?

How Do I Make a Payment?

automatic payments to be drafted from your bank

account. The choice is yours. Call 866-936-0602.

How Do I Pay My Contractor?

How Long Do I Have to Use My Loan?

When Is My First Payment Due?

When Does the Deferred Interest Plan Promotion Window Begin?

1GreenSky® Program is a program name for certain consumer credit plans extended by participating lenders to borrowers for the purchase of goods and/or services from participating merchants. Participating lenders are federally insured, equal opportunity lender banks. GreenSky® is a registered trademark of GreenSky, LLC. GreenSky Servicing, LLC services the loans on behalf of participating lenders. NMLS #1416362 2Interest is billed during the promotional period but all interest is waived if the entire loan amount is paid in full before the end of the promotional period.